Discharge of Surety from Liability

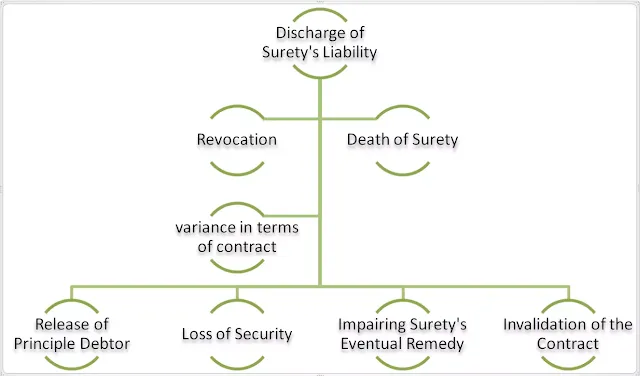

Discharge of Surety's Liability

The Contract Act, 1872 provides for the discharge of the liability of surety, in case of certain given circumstances. It means that surety's liability under contract of guarantee comes to an end. It comes to an end in any one of the following ways and the surety is discharged.

Modes of Discharge of Surety:

Notice of Revocation:

An “ordinary guarantee” cannot be revoked when it is acted upon. An

ordinary guarantee can be revoked by notice if the liability has not been

incurred. But a

continuing guarantee

may, at any time, be revoked by the surety as to future transactions, by

giving a notice to the creditor. The liability of surety comes to an end

regarding the future transactions after the surety has served the notice of

revocation. The surety remains liable for transactions entered into prior to

the notice. (Sec 30 of Contract Act)

Illustration:

- (a) A lends B a certain sum on the guarantee of C, C cannot revoke the guarantee, But if A has not yet given the sum to B even though the guarantee has been executed by C, C may revoke the guarantee by giving a notice. And if A gives the money to B after this notice than C will be liable.

- (b) Where the Directors of the company guaranteed the payment of the company’s overdrafts and subsequently resigned their office and the bank was informed, it was held that the liability would be confined to the amount due up to date of resignation.

Death of Surety:

In case of a continuing guarantee, the death of surety discharges him from

liability regarding the transactions after his death, unless there is a

contract to the country. The deceased surety’s estate will not be liable for

future transactions entered into after the death of surety, even if the

creditor has no notice of the death. (Sec 131 of Contract Act)

Discharge of surety by variance in terms of contract:

According to Section 133 of Contract Act, when any change is made in the

terms of the contract by the principal debtor and the creditor, without the

surety’s consent the liability of the surety terminates as to future

transactions.

Illustrations:

- (a) A becomes surety to C for B’s conduct as a manager in C’s bank. Afterwards, B and C contract, without, A’s consent, that B’s salary shall be raised and he shall become liable for one-fourth of the losses on overdrafts. B allows a customer to overdraw, and the bank loses a sum of money. A is discharged from his surety ship by the variance made without his consent, and is not liable to make good this loss.

- (b) The defendant guaranteed the conduct of a manager of a bank. The bank afterwards raised his salary on the condition that he would be liable for one fourth of the losses on discounts allowed by him. No communication of this new agreement was made to the surety. The manager allowed a customer to overdraw his account and the bank lost a sum of money. It was held that surety could not be held responsible as the fresh agreement was a substitution of a new agreement for the former which discharged the surety. (Bonar vs Macdonald)

By Release or Discharge of Principle Debtor:

According to section 134 of Contract Act the following two ways discharge

the surety form ability:

- (i) The surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released. Any release of the principal debtor is a release of the surety also.

- (i) The surety is also discharged by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor.

A contracts with B to build house for B within a stipulated time. B supplying

the necessary timber. C guarantees A’s performance of the contract. B fails to

supply the timber. C is discharged from his surety ship.

Arrangement by Creditor with Principal Debtor without Surety’s Consent:

According to Section 135 of Contract Act, where the creditor, without the

consent of surety, makes an arrangement with the principal debtor for

composition, or promises to give him time or not to sue him, the surety will

be discharged.

Illustrations:

The creditor had agreed with the principal debtor that the latter could pay

the debt in installment. It was held that it was a arrangement that would

discharged the liability. (National Coal Co. vs Kshitich Base &

Co.)

Impairing Surety's Eventual Remedy:

Section 139 provides that “If the creditor does any act which is

inconsistent with the right of the surety, or omits to do any act which his

duty to the surety requires him to do and the eventual remedy of the surety

himself against the principal debtor is thereby impaired, the surety is

discharged.

It is the duty of the creditor to do every act necessary for the protection

of the rights of the surety and if he fails in this duty, the surety is

discharged. A surety is entitled, after paying off the creditor, te his

indemnity from the principal debtor. If creditor’s act or omission deprives

the surety of the benefit of this remedy, the surety is discharged.

Illustration:

- (a) B contracts to build a ship for C for sum, to be paid by installments as the work reaches certain stages, (the last installment not to be paid before the completion of the ship). A becomes surety to C for B’s performance of the contract. C without the knowledge of A, prepays to B the last two installments. A is discharged by this prepayment.

- (b) A gives a guarantee to B for M’s honesty. B promises on his part that he will, at least once a month, see M make up the cash. B omits and M embezzles. A is not liable to B on his guarantee.

Loss of Security:

If the creditor loses or, without the consent of the surety, parts with any

security given to him, at the time of the contract of guarantee,, the surety

is discharged from liability to the extent of the value of security. If the

security is lost due to an act of God, the surety would not be discharged.

(Sec. 141)

Discharge of Surety by Invalidation of the Contract of Guarantee:

A surety is also discharged from liability when the contract of guarantee

(between the creditor and the surety) is invalid. A contract of guarantee is

invalid in the following cases:

(i) Where the guarantee has been obtained by misrepresentation:

Illustration:

A employs B as a clerk. B commits fraud. A, in consequence asks B for

guarantee, C gives his guarantee for B’s good conduct, A does not inform C

about B’s previous conduct: B afterwards makes default. The guarantee is

invalid.

(ii) Where the

guarantee

has been obtained by concealment of material facts.

(iii) Where guarantee has been obtained under the impression that

co-sureties will join and if, no body joins.

(iv) Where it lacks one or more

essential elements of a valid contract, e.g., surety is incompetent to contract or the object is

illegal.

Illustration:

A guarantees to C payment for iron to be supplied by him to B to the amount

of 2000 tons B and C have privately agreed that B should pay five rupees per

ton beyond the market price, such excess to be applied in liquidation of an

old debt. This agreement is concealed from A. A is not liable as a

surety.

CONCLUSION:

To conclude that a surety may be discharged:

- By revocation by the surety which can be done only in case of a Continuing guarantee in respect of future liability.

- By death of the surety.

- By novation.

- By variation of terms of contract without his consent.

- On the principal debtor being released or discharged by the creditor without surety's consent.

- Compounding by creditor with principal debtor without surety’s consent.

- Where creditor’s act or omission impaired surety’s eventual remedy.

- Where guarantee was obtained by fraud, misrepresentation or concealment of some fact

- On failure of consideration or contract lacks one or more essential elements of a valid contract