Rights of Surety in Guarantee

Rights of Surety in Contract of Guarantee

A surety is a person or party that takes responsibility for the debt, default or other financial obligations of another party. In simple words, the person who gives the guarantee in Contract is called Surety.

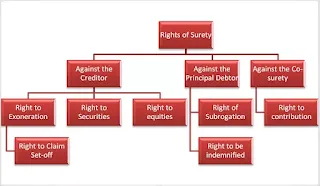

A surety has the following rights:

- (a) Against the creditor.

- (b) Against the principal debtor.

- (c) Against the co-sureties.

Rights of Surety against the Creditor:

The surety enjoys the following rights against the creditor:

1. Right of Exoneration:

A surety, after the guaranteed debt has become due and before he is called upon to pay, requires the creditor to sue the principal debtor.

2. Right to Securities:

on paying off the creditor, the surety steps into his shoes and is entitled to a securities which the creditor may have against the principal debtor, whether the surety is aware of the existence of such securities or not. According to Section 141 of Contract Act, the surety can demand from the creditor, at the time of payment the securities which the creditor has against the principal debtor at the time when contract of suretyship is made. Whether the surety knows of the existence of such securities or not is immaterial. If creditor by negligence parts with any security held by him, the surety is discharged to that extent from the payment of guaranteed sum. But if the security is lost due to unavoidable act, the surety would not discharged.

Surety can recover the securities only after making full payment. He cannot claim the benefit of a part of the securities if he has paid a part of the debt.

Illustrations:

(a) C advances to B, his tenant, Rs. 2000 on the guarantee of A. C has also a further security for 2000 rupees by a mortgage of B’s furniture. C cancels the mortgage, B becomes insolvent and C sues A on his guarantee. A is discharged from liability to the amount of the value of the furniture.

(b) C, a creditor, whose advance to B is secured by a decree, receives also a guarantee for that advance from A. C afterwards takes B’s goods in execution under the decree, and then, without the knowledge of A withdraws the execution. A is discharged.

(c) A, as surety for B, makes a bond jointly with B to C, to secure a loan from C to B. Afterwards C obtains from B a further security for the same debt Subsequently, C gives up the further security. A is not discharged.

3. Right to equities:

The surety, on making payment of guaranteed debt, is entitled to all equities which the

creditor could have enforced against the principal debtor himself, and also against the

person claiming through him.

4. Right to Claim Set-off, if any:

The surety is also entitled to the benefit of any set-off or counter claim, which the principal debtor has against the creditor in respect of the same transaction.

Set off: As per Merriam-Webster: a right to seek reduction or discharge of a debt or claim by countering a party's claim with an independent claim or,

a counterclaim made by a defendant against a plaintiff for reduction or discharge of a debt by reason of an independent debt owed by the plaintiff to the defendant.

Surety's Rights against the Principal Debtor:

The surety enjoys the following rights against the principal debtor:

1. Right of Subrogation:

It means that when the surety pays off the debt on default of the principal debtor he is entitled to all the rights which the creditor had against the principal debtor. The surety is entitled to all the remedies which are available to creditor against principal debtor. The surety may claim the securities, if any, held by the creditor and sue the principal debtor. (Sec. 140)

Illustration:

A director of a company guaranteed and paid the rent due from the company before the date of liquidation. It was held that he was entitled to stand in the place of the creditor and to use all remedies in the name of the creditor in an action to obtain indemnification from the principal debtor.

2. Right to be indemnified:

In every contract of guarantee there is an implied promise by the principal debtor whatever sum he has rightfully paid’ under the guarantee. In other words the surety can recover from the principal debtor, the amount which he has rightfully paid to the creditor.

Illustrations:

(a) B is indebted to C, and A is surety for the debt. C demands payment from A, and on his refusal sues him for the amount. A defends the suit, having reasonable grounds for doing so but is compelled to pay the amount of the debt with costs, He can recover from B the amount paid by him for costs, as well as the principal debt.

b) A lends money to B. C on the request of B accepts a bill drawn by A upon C to recover the amount. A the holder of the bill, demands payment of it from C and on C’s refusal sues him. C not having reasonable grounds for so doing, defends the suit, and has to pay the amount of bill and costs. He can recover from A the amount paid by him for costs as well as the principal debt.

Surety's Rights against the Co-surety or Co-sureties:

Where a debt is guaranteed by more than one surety, they are called co-sureties. In such a case all the sureties are liable to make the payment to the creditor according to the agreement among them. If there is no agreement and one of the co-sureties is compelled to pay the entire debt, he has a right to contribution from the co-sureties. Sections 146 and 147 provide the rules in this connection.

(a) Similar Amount:

Where there are sureties for the same debt and the principal debtor has committed a default, each party is liable to contribute equally to the extent of the default.

Illustration:

A, B and C are sureties to D for the sum of Rs. 3000 let to E. E makes default in payment. A, B and C are liable, as between themselves, to pay Rs. 1000 each. If C is insolvent and could pay only Rs. 500, then A and B will contribute equally to make good his loss.

(b) Different Amount:

Where there are sureties for the same debt for different sums, each surety is liable to contribute equally subject to the limit fixed by his guarantee. They will not contribute equally.

Illustration:

(a) A, B and C as sureties for D, guarantee for different sums. A Rs. 10,000 B Rs. 20,000 C Rs; 40,000. D makes default in payment to the extent of Rs. 30,000. Liability of A, B and C is Rs. 10,000 each.

(b) If D makes default to the extent of Rs. 40,000 then liability shall be used as of A, Rs. 10,000; B and C will pay equal share of the balance of 15,000 each.

(c) If D makes default to the extent of Rs. 70,000, then A, B and C will pay full amount of guarantee.

Conclusion:

In contract of guarantee a Surety has various rights against creditor, principal debtor and co-sureties such as Right to claim set off, subrogation, and equities. Rights of the indemnifier in Contract of indemnity are analogous to the rights of a surety under section 141 of the Act.